The GBP/USD pair remains subdued below 1.3600 following the previous session’s decline. The US Dollar Index is consolidating the recent pullback. The sterling is struggling amid an energy crunch, Brexit concerns and dismal economic data.

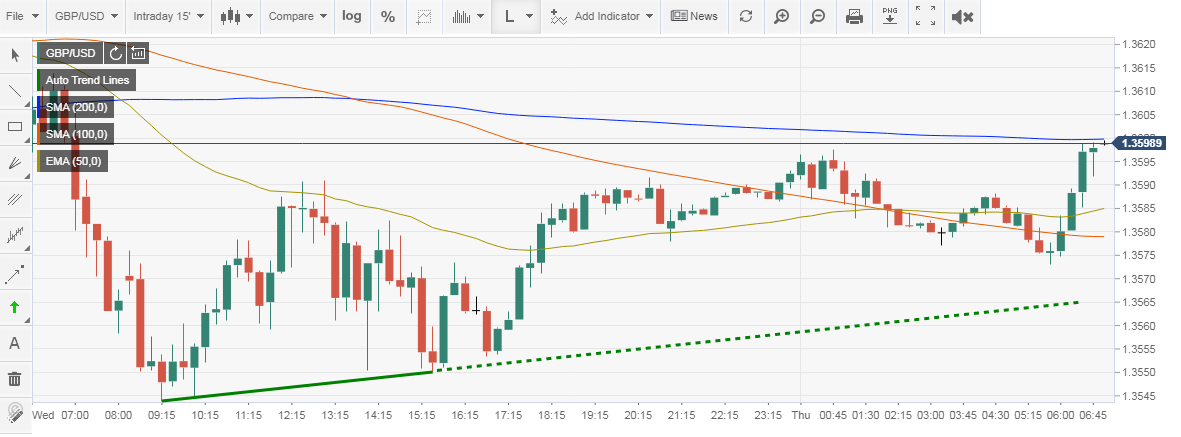

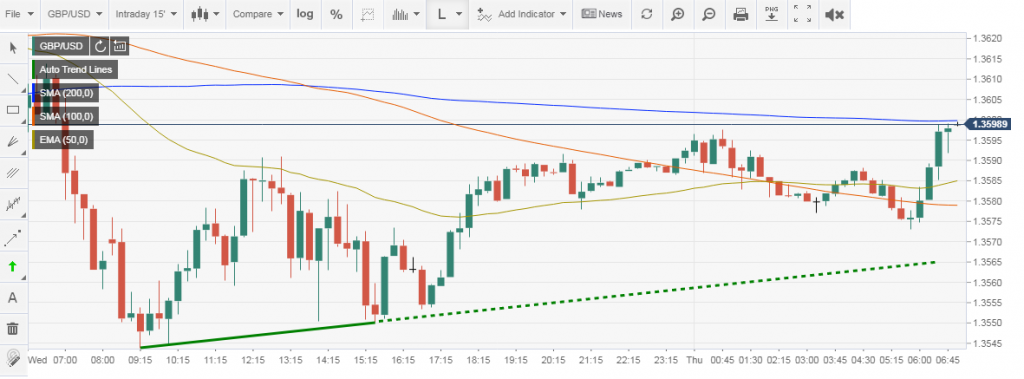

GBP/USD extend the recent rebound from the weekly bottom towards the 1.3600 threshold, near 1.3590 during the initial Asian session on Thursday. In doing so, the cable pair again bounces off 23.6% Fibonacci retracement (Fibo.) of September 14-29 downside, actually before that.

While the latest recovery moves aim for the 1.3600 round figure, a convergence of 100-EMA and a descending trend line from September 17, near 1.3635, joins the bearish MACD signals to challenge the pair’s further advances. Should the quote rise past 1.3635, 50% and 61.8% Fibo. levels, near 1.3660 and 1.3720 respectively, can test the GBP/USD buyers. Also important will be a one-month-old horizontal hurdle surrounding 1.3750-55.

The upbeat economic data underpins the attractiveness of the US dollar. The US private companies added 568k workers in September against the market expectations of 428K along with reports that Washington and Beijing have agreed to hold a virtual meeting before the end of the year.

On the other hand, the British pound continues to grind lower despite the assurance from UK Prime Minister Boris Johnson. He shrugged off Britain’s problem of empty gas stations, worker shortage and supply-side constraints while speaking at the party’s annual conference on Wednesday. The IHS Markit/ CIPS UK Construction Purchasing Managers Index (PMI) declined to 52.6 in September as compared to market expectations of 54.0.

As for now, traders keep their focus on the UK Halifax House Price Index and US Initial Jobless Claims to gauge the market sentiment.